…they do not know, they do not care, they do not have solutions, they do not lose sleep over sackings, and they do not represent the 80 Percent, minus the fuckers who voted for and love Trump

Close to home, mother fuckers:

WHAT WE DO & HOW

Bright Horizons serves a broad range of enthusiastic and hardworking participants. We focus on helping people of all ages reach their life goals through EAAT (Equine Assisted Activities and Therapies). Bright Horizons staff are certified to help those with a variety of special needs and disabilities. We believe that horses help each individual in their own unique way, and we celebrate differences and progress!

Our staff and volunteers are available to conduct a variety of educational and awareness programs that help support our primary mission. These programs include field trips, equine-awareness opportunities for challenged youth, public speaking engagements, and other types of community-based events.

Volunteers play a key role in making our mission a reality as well as keeping our program running. Our volunteers assist with a variety of tasks and responsibilities after receiving task-specific training. These tasks and responsibilities can include stall cleaning, arena set up, grooming, and saddling horses. Volunteers help in lessons by leading horses for participants, and oftentimes walking alongside them to assist as needed.

+—+

So the CEO of the non-profit that has Bright Horizons under its watch has created a huge toxic work environment. It is a larger organization than just the Horse Therapy program. But the director of the equine therapy program has given her 2 week notice, and there ain’t no replacement for her, and the 12 horses, well, are they destined for the glue factory?

Three mental health therapists have quit and two were let go:

This one was cut in the summer:

And this one:

You got it — LGBTQA+ and Latinos and Developmental and Intellectual and Psychological Disabilities. Just like the Cunt Musk and Cunt Trump and the Cunt Billionaires are envisioning and have envisioned.

Cut Cut Cut.

In my long and wide experience teaching and reporting and doing prison work and remedial ESL work and social work and work with homeless and jobless, well well, there is not one shred of Trauma Informed Care for the staff and lower fun folk.

+—+

Sackings and going after so-called blue states: Oregon’s unemployment rate is up 0.3% since January of 2024, reaching the highest levels since September of 2021, according to the Oregon Employment Department.

In January, the state’s unemployment rate reached 4.4%, 0.4% higher than the national average. Manufacturing and retail saw the largest declines within the past year.

“Manufacturing continued its decline of the past two years, cutting 6,900 jobs (-3.7%) in the 12 months through January, while retail trade shed 2,300 jobs (-1.1%) during that time,” the Oregon Employment Department said.

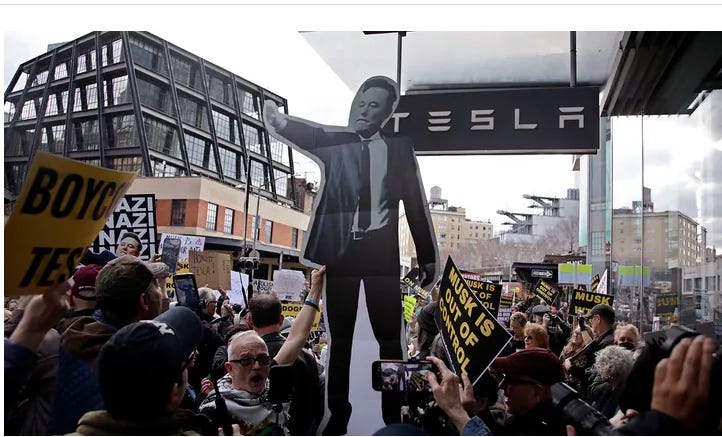

It’s a mafia, this society, and dog-eat-dog ain’t no new thing with Rapist in Chief Trump, but he is on the prowl with Nazi Musk and Nazi Thiel and the 11 Fascist Billionaires in the Open and hundreds more in the shadows grifting and gouging and gutting.

And the fuckers at the local restaurant of whom I overhead, and who voted for the cunt and want the military to be triple budgeted, they love the fucking lies and white male military PR. Really. Fucking crab catchers.

See them all come to Ohio and cum all over themselves?

DEI on parade:

Dirty Entitled Icteric Idiocracy — DEI & I!

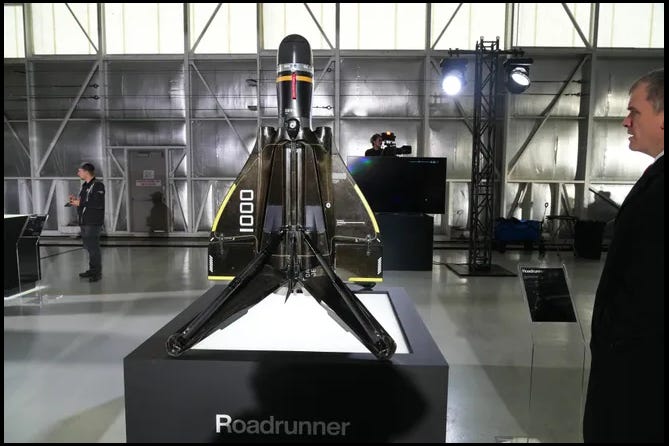

Locally, Anduril plans to add 4,000 new jobs at a $900 million facility in Pickaway County at Rickenbacker International Airport by 2035. Those hired will work in a 5 million square foot manufacturing facility named “Arsenal 1,” according to a previous company announcement.

Anduril engineers work on everything from artificial intelligence to robotics, software, sensors, secure networking, aerospace and virtual reality technology, according to the company’s website.

Yeah, Putin, you putting trust in the fucking Jews and Trump?

The British arm of a drone manufacturer planning a nearly $1 billion weapons facility near Rickenbacker International Airport has reached an agreement to provide drones to Ukraine for its war with Russia.

The British government said on Thursday it had struck a deal with defense tech company Anduril UK to allow Ukrainian armed forces to use more advanced attack drones in the Black Sea. Anduril UK is part of Anduril Industries, based an hour south of Los Angeles in Costa Mesa, California.

This is AmeriKKKa, man, no need for K12 or universities: In his Feb. 25 op-ed “Bring Warriors Back to the U.S. Military,” Mike Gallagher proposes focusing military recruiting on a combat-first approach, emphasizing physical fitness, a warrior mindset and the prospect of “bad food, little sleep and long deployments.” This would be spot-on if we were still living in the 19th century. In the 21st century, however, warfare is dominated by highly computerized weapons systems, including advanced radars, stealth aircraft, drones, hypersonic missiles and directed energy weapons. Doing pushups and hiking 50 miles has little to do with being able to operate and maintain such sophisticated systems, much less protect them from cyber attack. The military will always need Rambos, but in the 21st century it will need as many if not more Sheldons too.

+—+

Oh Liz and Bernie and the rest of the DNC, didn’t see this coming?

When it comes to military recruitment, President Biden left President Trump a flaming bag of you-know-what on the White House steps. Mr. Biden sapped the ranks of America’s military when he discharged more than 8,000 members for noncompliance with his Covid-19 vaccine mandate. These dismissals compounded the morale catastrophe of the Pentagon’s diversity, equity and inclusion push, best understood as a pseudoscientific attempt to favor loyalists at the expense of merit-based promotions and military readiness.

The Navy and Air Force missed their recruitment targets in fiscal 2023 for the first time this century. The Army missed its enlistment goals in 2022 and 2023, and the Marine Corps barely met its target in 2024. The most advanced weapons systems are useless without talented, motivated soldiers to operate them. Any military recruitment crisis emboldens America’s enemies. Resolving the Biden-created recruiting crisis is as important as securing our borders.

+—+

Yeah, no more trains and civilian ferries and cars and buses. Bring on the Nazi Equipment:

Germany’s economy should embrace the pivot from cars to defense equipment as a major growth driver, according to a proposal by the country’s leading defense industry group.

The Federal Association of the German Security and Defense Industry (BDSV) pitched the idea last week while hailing the incoming government’s pledge to continue expanding the defense budget drastically. To overcome production bottlenecks, the argument goes, why not repurpose manufacturing capabilities of Germany’s famed, but ailing, automobile sector?

+—+

Fucking Fascist Germany.

Is it possible to work every day yet still sleep on the street at night? This is reality for thousands of people in Germany who have jobs but are unable to obtain housing.

+—+

Here we are, don’t you know you fucking crocodile tears Scott Ritters and the lot of you whining military mutts.

China Could Attack Pearl Harbor—and the West Coast By Lieutenant Colonel Thomas McCabe, U.S. Air Force Reserve (Ret.)

+—+

Lies, and more lies and fabrications and, well, more fucking retired cunts that need their benefits cut.

And our masters, the Jews: IDF plans to summon 14,000 haredim, expects shortfall in 2025 draft goals

The IDF said it expects to miss its 2025 goal of 4,800 recruits by 1,800.

Oh, that’s right, a trade war with Europe.

US arms exports to Europe triple, boosted by Ukraine aid: SIPRI

Shipments of U.S. weapons to Europe rose 233% in the 2020-2024 time frame from the prior five-year period, according to a March 10 report by the Swedish think tank. For the first time in two decades, Europe accounted for the largest share of U.S. arms exports, SIPRI said.

This is the new AmeriKKKa — arms, jets, bombs, drones, AI, satellites, weaponizing the mind — the mind is a battlefield.

The Army is grappling with a staggering attrition rate among newly enlisted troops, even as recent recruiting figures suggest the service is clawing its way out of a yearslong enlistment crisis.

Nearly one-quarter of soldiers recruited since 2022 have failed to complete their initial contracts, according to internal Army data reviewed by Military.com. While the Army’s recruiting totals look solid on paper, a high dropout rate raises serious doubts about whether those numbers are an accurate portrayal of how well the service is manned.

It remains unclear why the Army is losing so many soldiers, but one explanation could be the declining quality of its recruiting pool. One-quarter of all enlistees last year had to go through at least one of the Future Soldier Preparatory Courses, which were set up as a sort of silver bullet for recruiting woes — getting applicants up to snuff with academic or body fat enlistment standards before they ship out to basic training.

+—+

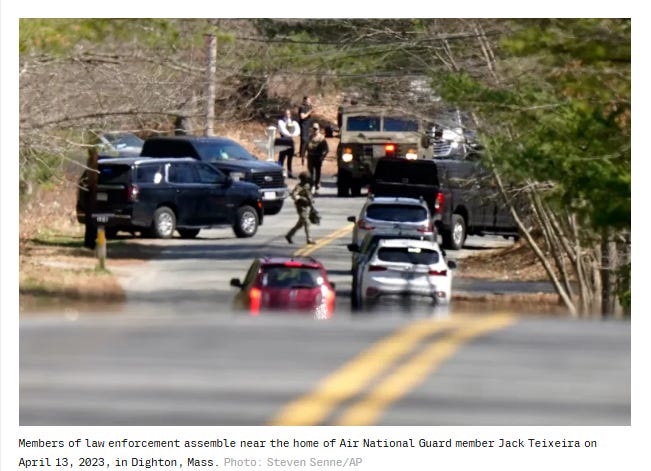

Hero!

These are not protectors of truth, nor are they soldiers of the Fourth Estate:

With Pentagon Leak, the Press Had Their Source and Ate Him Too

Whatever Jack Teixeira’s motives, he’s accused of sharing documents that have underpinned major stories in the same outlets that helped hunt him down.

The final tour, Yankee Doodle Dandy: There is free-riding among the US military services, too

Ahh, allies: Elon Musk says X facing ‘massive cyberattack’ originating from the Ukraine area. Musk says X cyberattack was done ‘with a lot of resources,’ suggests ‘large coordinated group’ using IP addresses from the Ukraine area were involved.

And, more of our dollars stolen, in the trillionss:

Ahh, taxes for the rich, gone gone gone:

Yeah, more white trash: Rising home prices, the increasing cost of rent, and high mortgage rates are each contributing to major financial problems for many Americans.

New York University professor, author, and podcaster Scott Galloway urges people to understand the real estate and housing predicament in a different way.

The author explains that about a third of Americans pay for rent, not mortgages — and cites a United States Census Bureau report that found 49.7% of the 42.5 million renter households were “cost-burdened” in 2023, meaning that they spent more than 30% of their income on housing costs.

Galloway reports that, since 2019, rents have risen at a pace one-and-a-half times as fast as income in most metropolitan areas.

Another Jew giving us the tips to the stock market!

+—+

As someone who makes $16 million per year, Galloway does not think he should be eligible to collect Social Security when he retires. Rather, he supports means-testing as a tool to determine whether one qualifies for benefits.

The podcast host clarifies that he pays $9,000 in Social Security taxes every year. And he says that is the same amount someone who makes $160,000 annually pays.

Galloway believes that most people who collect Social Security take out two to three times the amount of money they contribute to it through the tax. People who are extremely well off, he suggests, do not necessarily deserve the money just because they have paid the tax during their working years.

+—+

“Saving” Social Security

A Neoliberal Recapitulation of Primitive Accumulation

(Dec 01, 2000)

Alan G. Nasser teaches philosophy and political economy at Evergreen State College in Olympia, Washington. His article “The Atom Bomb, the Cold War and the Soviet ‘Threat’” appeared in the December 1989 issue of Monthly Review.

Dean Baker and Mark Weisbrot, Social Security: The Phony Crisis (Chicago and London: The University of Chicago Press, 2000), 175 pp., $22.

The pronounced insecurity that inevitably attends capitalism’s historic tendency to commodify, and hence privatize, everything that can be commodified and privatized has been met with two major forms of resistance. The first is revolutionary communism, which emerged in the latter half of the nineteenth century and the second is social democracy, which developed in its strongest form in Europe after the Second World War. A defining feature of our present situation is that neither of these forms of resistance to capitalist hegemony is currently a major historical force.

The absence of major challenges to capitalism has led to an attack on the social and economic policies that lessen the dependence of the working population on the vagaries of the market and the demands of capital. Neoliberalism is now mainstream orthodoxy: regulation of business activity is to be eased, publicly owned enterprises are to be privatized, and the services and income supplements that have constituted the social wage are to be notably reduced or outright eliminated. This massive assault on the security of working people has met with no small measure of success: the real income of the typical US worker has been in decline for at least two decades, the number of medically uninsured individuals has risen, and both intra- and international inequalities have reached levels unmatched since the Great Depression. In the United States, the decline of workers’ real income has been accompanied by an overall shift of national income from labor to capital.1

The 1990s have seen two tremendous attacks by the rulers on the welfare and security of working people. The first, in 1996, resulted in a ruling-class victory: the sixty-year-old federal income guarantee for poor families was abolished. The second onslaught is still underway. It aims to cut benefits and at least partially privatize the Social Security system, which would no longer function as a system of social insurance, protecting all workers in the face of any misfortune that might befall them. Groups such as the Urban Institute, the Concord Coalition, the Cato Institute, and the National Center for Policy Analysis have produced a barrage of studies and statistics designed to undermine the most successful US program explicitly intended to reduce poverty. Jeanette Nordstrom of the National Center for Policy Analysis makes the aim of her organization clear: “to break the strong tie between the taxes employees pay during their working years and their right to a pension later on.”2 The media have on the whole communicated this agenda to the American people under the rhetoric of the “crisis” that Social Security faces and the corresponding need to “save the system”—presumably by excising its guts.

Social Security is often characterized as a pay-as-you-go arrangement under which current benefit payments are financed out of current payroll taxes. Yet, rather than conforming strictly to a pay-as- you-go principle, whereby current proceeds are immediately spent to meet current obligations, Social Security has been structured along actuarial lines (used by insurance companies) almost from the beginning. This has required the amassing of trust funds to meet future exigencies. Since 1984, the system has been building up a surplus of tax revenues over benefit payments, which the Social Security Administration (SSA) is required by law to use to buy US Treasury obligations. It has accumulated almost one trillion dollars in these government bonds and continues to add to this amount to the tune of more than one hundred billion dollars a year. (The current surplus stands at about 150 billion dollars.) According to figures accepted by all sides of the debate, the program will take in enough revenue to pay all promised benefits for almost forty years, without any change at all in the tax or benefit payout structure. (Baker and Weisbrot’s analysis is based largely on the then-latest figures released by the SSA in April 1999, which projected a revenue shortfall in 2034. SSA’s 2000 report, released last March, revises this projection to 2037. It’s worth noting that for years, SSA set the dreaded date at 2029.

Their 1998 report jumped the date to 2032, and the 1999 report to 2034. With the current wisdom projecting to 2037, we can probably expect further postponements of Judgment Day. This is remarkable in itself. What other project of this size, private or public, is able to guarantee its benefits for almost four decades?)

So what is all the fuss about? Most Americans seem to believe the scenario, put forward by pro-privatization think-tanks, politicians, and the media that (in the words of a 1998 report by the Heritage Foundation) “the Social Security system is bankrupt.” It is this belief that leads many Americans to support neoliberal demands for privatization. The stock market is touted as a more secure investment outlet for workers than an allegedly insolvent fund managed by “big government.” After all, haven’t stocks been making money for “us” hand over fist for years?

Baker and Weisbrot show in great detail that both the diagnosis of bankruptcy and the prescription of privatization are nonsense. Unlike most economists, the authors’ historical literacy is formidable and their quantitative and theoretical sophistication dwarfs the kind of confused and disingenuous sophistry coming out of the right wing think-tanks. They argue rigorously from the same set of economic and demographic assumptions and the same numbers that the privatizers play fast and loose with and demonstrate conclusively that the recommendations of the “reformers” are entirely inconsistent with undisputed facts. The pessimism of the general public regarding Social Security’s future, created with the assistance of an uncritical media establishment, is testimony to perhaps the greatest public-relations scam in contemporary America. (And the hoax extends to another major form of social security; Baker and Weisbrot also include a detailed analysis of the phony Medicare “crisis.”)

What are the relevant facts? In 2014 (now 2015 according to Baker and Weisbrot), the benefits paid out by Social Security are projected to slightly exceed taxes received. But does it follow from this that Social Security is “going broke?” Of course not. The privatizers know full well that the funds borrowed from Social Security by the US Treasury are to be paid back, as they have been since the system’s inception, with interest. Accordingly, the system’s total income consists of payroll taxes plus interest income. At the end of 2014, the system is projected to take in 585 billion dollars (in 1999 dollars) in taxes and 137.9 billion dollars in interest payments for a total income of 722.9 billion. And it will have nearly 2.3 trillion dollars in assets. With benefit payments projected at 592.7 billion dollars, the total income of the system is thus expected to exceed benefit payments by 130 billion dollars. The figures show that Social Security’s total income will be able to cover all benefits until 2022. From that point until 2034, Social Security will be able to pay all benefits by drawing on the principal of its accumulated assets. (These figures were reported by Baker and Weisbrot in 1999. Recall that this year’s projections have extended the year of reckoning to 2037.)

Note how mainstream economic reporting misrepresents these figures. Katharine Q. Seelye recently reported for the New York Times (May 14, 2000, section 1, p. 22) that Social Security “will begin paying out more than it takes in by 2015.” (The 2015 date extends the 2014 projection available to Baker and Weisbrot.) Does Seelye think that what Social Security “takes in,” i.e., its income, is exhausted by payroll taxes? As we have seen, an additional component of Social Security’s annual income is the interest on the Treasury bonds it holds, which accounts for the 270-billion-dollar surplus the system is officially projected to have in 2015. In fact, this surplus was planned precisely in order to cover the anticipated shortfall. Seelye adds insult to injury when she further claims that “without a major fix, the system could go broke by 2037.” But Baker and Weisbrot show that the contribution from interest payments makes it possible for the system to pay all benefits out of its income until 2022. From then until 2037, it will draw on the principal in the trust fund to maintain full benefit payments. These payments can be further extended through 2074 with a mere 2.07 percent payroll tax increase, about 1 percent each for employer and employee. If the economy were to limp along at a growth rate somewhat lower than its present relatively low rate, indeed, if the economy simply manages to avoid a major depression, the “crisis” of Social Security, as defined by the privatizers, simply vanishes. This point requires further elaboration, as it touches on one of the principal contradictions in the case for privatization.

The SSA trustees are required by law to produce annual projections of the system’s future financial status. The assumptions of the generally accepted projection are astonishing. The economy is projected to grow at an average annual rate of just under 1.5 percent over the next seventy-five years. (This year’s report revises that figure to just under 1.7 percent.) This means that the economy is expected to perform worse than in almost any previous period in US history. Now if this scenario were taken seriously, one would expect the alarm to be sounded not over the “crisis” of Social Security, but over the forecast that we may well be heading for an extended period of severe economic stagnation. Neoliberals have seized upon this slow-growth assumption to argue that the economy will generate insufficient income to cover Social Security benefits. Their case is conspicuously incoherent: the privatizers’ central recommendation is that a portion of workers’ income be transferred to private accounts invested in the stock market. But how can the stock market be expected to provide robust returns in an economy that is projected to be in virtual long term depression? The privatizers’ assumption that future stock market returns will reflect past returns stands in stark contradiction to their reliance on SSA’s ultra-pessimistic growth forecast.

We have recently experienced the fastest increase in stock prices in US history. MR readers are familiar with the underlying source of this phenomenon: the pronounced evaporation of profitable investment opportunities in industrial production since the mid-1970s has drawn what would otherwise be idle wealth into the gambling casino of the financial superstructure. The dramatic increase in stock prices is therefore unrelated to the behavior of corporate earnings. This is to say that the stock market is now massively overvalued. Historically, a share of stock has been valued at fifteen dollars per dollar of earnings. After the recent market takeoff, stock shares were selling for more than thirty dollars for each dollar of earnings. It is sheer folly to imagine that the stock market will continue to soar at a rate that bears no relation to the condition of the underlying economy. And it is not only the SSA trustees who foresee a grim picture for profits. The Congressional Budget Office (CBO) provides economic projections to Washington legislators debating tax and spending plans for the future. CBO anticipates after-tax corporate profits to decline by 4 percent over the next decade. The combination of current stock (over)valuations and official projections of low profit growth, both well known to Washington politicians, make it fanciful in the extreme to count on the stock market to sustain its historic rates of return. This has been demonstrated in painstaking detail by MIT professor Peter Diamond, a leading expert in public finance, and Dean Baker, who both show that the stock- return projections used by the privatizers in their calculations of the benefits of a privatized system are historically and mathematically preposterous.3 Assume that stock prices continue to outpace profits. The current price to earnings ratio of thirty-to-one would, on the privatizers’ prediction that stock returns of 7 percent can be sustained as the economy grows at half its past rate, rise to 230-to-one by 2055. Who can imagine that investors would continue to hold stocks, as opposed to government bonds, in these circumstances? When stock prices have risen this far from the earnings potential of the stock’s underlying assets, we have the ingredients of a major stock-market crash. This kind of catastrophe appears to be implicit in the argument of the privatizers.

Keep in mind that the accuracy of SSA’s and CBO’s dire growth projections is not what is at issue here. The point is that the privatizers’ case is conspicuously unsupported by their own data and self-contradictory to boot. To adhere simultaneously to optimistic stock-market projections and pessimistic growth projections is to try to have one’s cake and eat it too. Adherence to either of the projections entails the rejection of the other. George W. Bush has recently been impaled on the horns of this dilemma. The Washington Post reported that Bush’s aides defended their optimism regarding future stock returns by claiming that SSA’s economic projections are too pessimistic (Glenn Kessler, “Bush Proposal Ventures Into Financial Unknown,” May 16, 2000, p. A6). But if that’s true, then Social Security is in good shape and Bush’s case for privatization collapses. We have not seen slapstick logic on this order since Abbott and Costello.

The complicity of the mainstream media in the perpetuation of this entire hoax is all too familiar and hard to underestimate. It is not as if there are absolutely no references to the facts on the glaring inconsistencies of the case for privatization. It’s just that the relatively very few citations of serious scholarship have no net effect on the overall impression communicated by the media. In early 1996, Robert Pear of the New York Times wrote a major story discussing Dean Baker’s position on Social Security, which was run as written by the Pittsburgh Post-Gazette. But when it appeared in the Times, Baker’s criticism of the case for privatization had been cut. The Times did publish an article by one of its own editors, Fred Brock, titled “Save Social Security? From What?” in its Business section (November 1, 1998, p. 12), which favorably quoted Weisbrot and Baker. Brock went on to attribute the hysteria of the privatizers to “hidden agendas.” And it continued, “Wall Street would love to get its hands on at least some of the billions of dollars in the Social Security trust fund…But knowing that the idea [of full privatization] won’t fly politically, [politicians] are pushing for partial privatization, in which individuals would invest a portion of their contribution in the stock market, all in the name of rescuing the system.” Still, in the very same issue, the lead editorial claimed that “The next Congress will have to deal with nothing less than…devising a plan to save Social Security in the next generation” (p. 14). Last May, the Times ran a piece (“Money For Nothing,” May 28, 2000, p. 11) by its Op-Ed economics columnist Paul Krugman that criticized Bush’s stock-price projections. Yet none of this has made any difference to the neoliberal propaganda that pervades the newspaper’s front-page reporting on this issue.

Fact checking also seems to be nonexistent when it comes to Social Security. The myth of the “baby boomers,” whose retirement will allegedly bust Social Security, is repeated as factual. But as Baker and Weisbrot show, the accommodation of the flood of boomer retirements from 2010- 2030 has already been taken into account in the financing of Social Security. In 2037, the earliest year in which Social Security is currently projected to face financial difficulties, the biggest effect of the baby boom generation on retirement will be nearly over—the oldest baby boomers will be ninety-one and the youngest seventy-three, eleven years older than the minimum Social Security retirement age. The baby-boomer scare is factually off the wall, but you’d never know it reading the papers.

As noted at the beginning of this essay, the campaign to privatize Social Security is now the front line in the global war of neoliberalism against working people. In this onslaught, we find echoes of what Marx called “primitive accumulation.” The world into which capitalism was born was not pervaded by market institutions, which is to say that human needs and desires were satisfied by means that did not on the whole render people dependent on markets for their livelihood. The historic mission of capitalism is to transform this situation by making people’s ability to get what they need and want contingent upon their ability to strike a deal on a market, i.e., a deal that contributes directly capital. From the capitalist point of view, the ideal situation is one in which everyone is dependent upon the market for everything they desire. Every human activity should contribute to the accumulation of capital. Precapitalist social and economic space was not hospitable to this imperative. Most importantly, there were customary and traditional entitlements and rights of access to productive resources, e.g., land and the instruments of labor, to which one was guaranteed access simply by virtue of one’s membership in one’s clan, family, village, or kingdom. It was capitalism’s original business to abolish these traditional use rights on which most working people depended for their livelihood. These common customary entitlements were correctly seen by capitalist landlords as interfering with their ability to accumulate private, self-expanding wealth, i.e., capital.4

The forced enclosures of common land first begun on a large scale in sixteenth-century England were succeeded by “Parliamentary enclosure,” when acts of Parliament formally reconstituted common resources as private property. Indeed, the history of enclosure in England from the sixteenth to the late eighteenth century might be termed the “primitive privatization,” the historical progenitor of the contemporary neoliberal project to privatize and deregulate everything. The Parliamentary enclosures transformed what had originated as a wave of coerced expulsions into a political process, the legally sanctioned removal of any obstacles to the ongoing and limitless accumulation of capitalist wealth.

This secular tendency of capital to universally privatize was temporarily offset in the middle of the twentieth century by the emergence of the New Deal in the United States and social democracy in Europe. But even these meager provisions of non-market benefits proved to be too radical for capital. Born-again capitalism is now the order of the day, and social security is once again, as it was way back then, a principal obstacle to profitability. The struggle of large English landowners to privatize historically common land finds its contemporary counterpart in the campaign of big banks and Wall Street brokerage houses to put to private, profitable use resources currently earmarked for workers in need. Just as the social costs of the transition to capitalism were borne by the working population, so too the attempted transition back to pre-Keynesian capitalism will be borne by the same class. The administrative costs of privately managing a huge number of individual accounts in Chile and Britain amount to over 16 percent of the systems’ annual revenue. If the US system was run in a comparable way, about seventy billion dollars would be transferred every year from workers’ retirement accounts to brokerage houses and banks. Administrative costs under the present system, on the other hand, amount to less than 1 percent of total benefits paid each year. It would be about forty years before the first generation of private Social Security investors could retire on the returns from their individual accounts. Since current benefits will continue to be paid out of the system’s current income, how will four decades of beneficiaries be able to receive their payments if a substantial portion of Social Security tax revenue continues to be diverted to individual private accounts? Surely not by tapping the resources of others’ private accounts. Barring sharp cuts in benefits, tax increases will become a virtual necessity and these will be enough, as Baker and Weisbrot point out, to ensure a negative return overall for the first generations of privatized savers.

If working people knew all this, they would not support this venal agenda. One of the principal tasks of the socialist left is to fill the factual and analytical vacuum created by the corporate media. As immediate educational tasks go, none is more urgent than this one.

Notes

- L. Mishel, J. Bernstein, and J. Schmitt, The State of Working America, 1998-1999 (Ithaca: Cornell University Press, 1999).

- Quoted in Trudy Lieberman, “Social Security: The Campaign to Take the System Private,” The Nation, January 27, 1997, p. 13.

- Baker’s arguments can be found in his detailed letter to the Harvard economist Martin Feldstein at http://www.cepr.net/letters/feldstein_1999_05_15.htm, and Diamond’s “What Stock Market Returns to Expect for the Future?” at http://www.bc.edu/bc_org/avp/csom/executive/crr/ib2.htm.

- For a fuller discussion, see Ellen Meiksins Wood, The Origin of Capitalism (New York: Monthly Review Press, 1999.)

SharePrevious