…. but it pays so well exploiting the masses, making shekels on the poor, jumping land claims on the agrarians, spiritually mutilating the masses with their knives a 10 million cuts

It always surpirses me with the humanity, the humane nature of most of the people I get to know, that is, who I seek out and get to get under their skin.

It can be dreadful being me, an antagonizer, agitator, unhappy in LaLaLandia, confrontational, oppositional, devil’s in the details and how the sausage is made advocate.

It is in the art, man, the sheer volume of passion and creative creation’s best where we find, or at least I do, the point between inhumanity and leaping poetry, people who can leap above station, caste, class, econonmic strata, ethnicity, national origin.

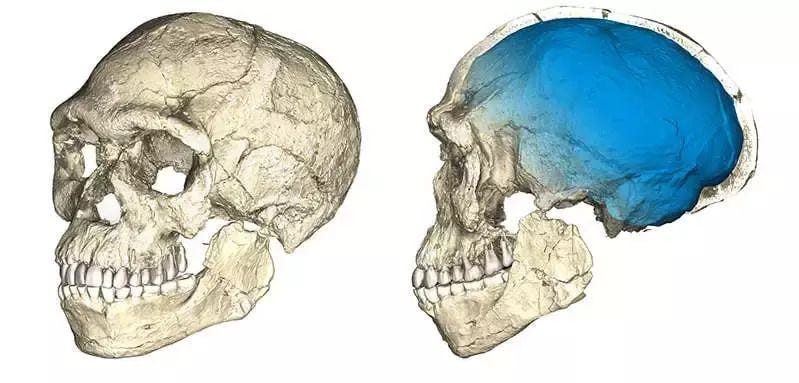

Yet, so much of “we” are those roots, those passages from the very beginning, Sub-Saharan Africa to “here.”

A single root mother, or several branches?

The oldest fossils from early humans come from Africa, and the first modern humans likely came about around 315,000 years ago. Between 300,000 and 100,000 years ago, evidence of modern humans was spread throughout the continent—more support for the multiple origins theory, Scerri tells Nature News. Had humans originated in one spot, the oldest artifacts would be found there, with increasingly more recent remains found at sites emanating from the origin, but that is not the case, she tells the publication.

European milfoil or zebra mussels or flotsam, jetsam, lagan, and derelict shipwreck. [Photo: Stone tools from Jebel Irhoud, Morocco, where the earliest modern human fossils were discovered.]

This forensics proposition is compelling on one level: “A view from Mota Cave in Ethiopia, where archaeologists found the remains of a 4,500-year-old human. Kathryn and John Arthur

An ancient skeleton found face down in an Ethiopian cave has enabled scientists to sequence one of the first ancient African human genomes.

The sequenced genes are helping to define a wave of Eurasian migration back into Africa that now appears twice as large as previously believed—even if the reasons for the migration remain a mystery.

“This back migration of Western Eurasians to Africa was a very large, one-off event, it seems,” says study coauthor Marcos Gallego Llorente of the University of Cambridge. “Its genetic signature got to every corner of Africa.”

All humans trace their genetic roots back to Africa, but some modern Africans have a surprisingly large percentage of Eurasian ancestry due to the Eurasian backflow, a previously known migration from the Near East and Anatolia into the Horn of Africa.

However, heat is an enemy of DNA preservation, and until now, most genomes of ancient Homo sapiens have emerged from Earth’s cooler regions. With no ancient African genomes in hand, scientists had to work backward with modern genes, attempting to peel off more recent changes to reveal older genomes and produce a genetic baseline.

Teasing out a starting point this way has been a challenge. Events like the backflow migration, along with later population movements around Africa, have scrambled genetics across the continent. Still, working with modern genomes, geneticists had estimated that the Eurasian return to Africa happened some 3,000 to 4,000 years ago.” (source)

We are seekers, in the pure sense of wanting to know roots, origins, commonalities, our shared humane humanity.

HE DIED later than Socrates and Aristotle, but a man who fished along the coast of southern Africa is the closest genetic match for our common female ancestor yet found.

If you trace back the DNA in the maternally inherited mitochondria within our cells, all humans have a theoretical common ancestor. This woman, known as “mitochondrial Eve”, lived between 100,000 and 200,000 years ago in southern Africa. She was not the first human, but every other female lineage eventually had no female offspring, failing to pass on their mitochondrial DNA. As a result, all humans today can trace their mitochondrial DNA back to her.

Within her DNA, and that of her peers, existed almost all the genetic variation we see in contemporary humans. Since Eve’s time, different populations of humans have drifted apart genetically, forming the distinct ethnic groups we see today. (Found: closest link to Eve, our universal ancestor . . . . A man who died in 315 BC in southern Africa is the closest relative yet known to humanity’s common female ancestor – mitochondrial Eve)

Fascinating, this quest for Eve, for fire. I’m going to do a 180 degree brodie here and promote a compelling jazz interpretor, writer, storyteller: Lynn Darroch.

A tale of the Modoc War and Winema, the woman who served as mediator and translator between natives and miners/soldiers/settlers in the brief period in which the world changed completely for the native people of the Klamath Lake area.

Listen to Lynn, which I do on the Portland Jazz station, KMHD.org.

Enchanting. Link to Lynn.

Then, another 180 degree switch, in fact, the genesis of this short blog (rare rare for me me myself myself and I I).

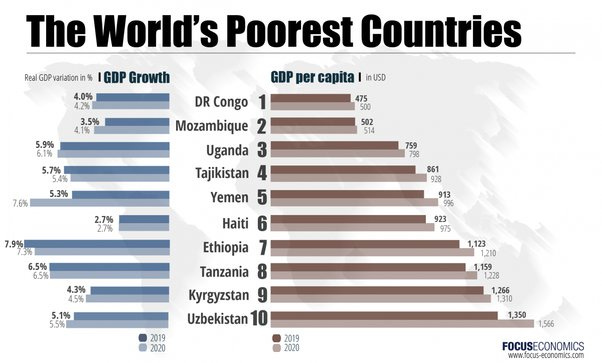

I can’t believe monsters and misanthropes like these share my Eve’s DNA, for sure. And there a millions of these folk throughout “civilization,” the takers, the conquerers, the corrupters, criminals, abusers, and now now, we have to like good thrid grade reading level fools listen to these scum because the third grade reading level writers and TV presenters are enamored: “Warren Buffett Believes The US Has An Obligation To Take Care Of People Who’ve Become ‘Roadkill’ Because Of Circumstances Beyond Their Control — ‘That’s The Obligation Of A Rich Country’“

Roadkill, and those circumstances are planned obselescene, death, exploitation, enslavement, disenpowerment, disenfranchisement, cogs in their machines, the foot soliers for their wars, their capitalist proving grounds, subjects for body-soul-mind experiments in every tool and contracted sickness the Gates and Buffets have jiggered.

CIRCUMSTANCES? Can you believe these sociopaths?

Oh, the horror, the horror, the whores. Here’s the trash heap of 100 brought to us by the trashiest Forbes: Billionaires 2023: The Richest in 2023

A list like this, all those smiling fucking faces, oh those roadkill killers, the ambulance chasers, the titans of poverty making. Useless baggage, 500,000 satellites in space motherfuckers.

Out common ancestor?

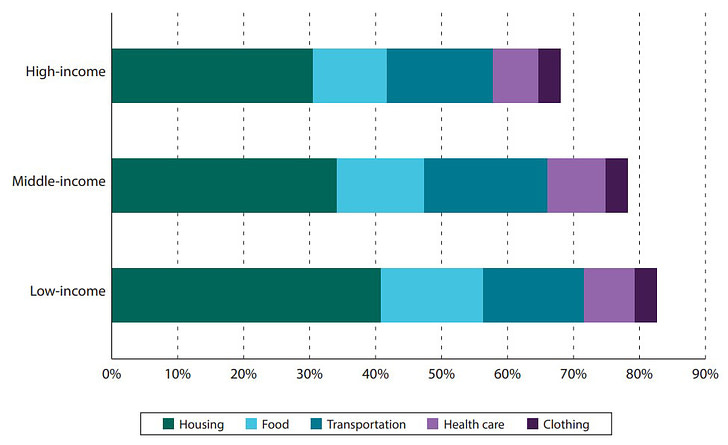

Why poverty costs a lot of money for the poor and why the abusers get rich off of it — PayDay loans, courts, hospitals, loan collectors, repossessions, dirty food, dirty housing, fenceline communities, environmental racism, mountaintop removal, gaslands, piles of filth and garbage to pull through.

- Housing

- Food and Groceries

- Transportation

- Healthcare

- Financial Services

- Childcare

- Communication

- Taxes

Just read on down, a piece from Alternet, not my cozy little place for radicalism:

Roadkill?

[Contaminated water from the town of Stephens, Wise County Va.]

In this article, we look at the 25 poorest cities in the US that are getting poorer, or growing at the slowest rate. You can skip our detailed analysis of the causes of poverty in these cities and head directly to the 10 Poorest Cities In The US That Are Getting Poorer.

A recent analysis on the 50 Poorest Cities in Every State in the US identified the poorest city in each state in the United States, using last 12 months’ poverty data released by the U.S. Census Bureau’s 2021 American Community Survey.

Fucking ROADKILL. Monsters in that Forbes “top” sociopath rich people, they deserve death. Each stock and bond and product and theft of resource here and there is on the backs and bodies and minds of us, the ROADKILL.

10 of the most dangerous places to be a child

Being Poor Is More Expensive Than You’d Think

Joshua Wilkey This Appalachian Life August 08, 2017

Poor people are cash cows.

It makes no sense, really. One would think that poor people, by virtue of being poor, would not be profitable customers. However, for many large corporations that target the poor and working poor, there’s big money to be made on the backs of those who have no money.

At Dollar General Store locations, customers can get cash back on their purchases. This is not novel. In fact, most all retailers these days offer this option. Soccer moms get cash back so they can have lunch money for their children. Restaurant patrons can get money back to leave a cash tip for their servers. I sometimes get cash back at the grocery store so I can buy Girl Scouts cookies on the way out. It’s a simple process. Click “yes” when the little screen asks for cash back, tap the $20 icon, and the cashier hands you some bucks along with your receipt. We’ve all done it. For those who are poor and those of us who are not but who have limited retail options, however, there’s often a sinister catch.

I noticed this a few years ago, first at Dollar Tree, then at Dollar General. There’s a little asterisk after the standard “would you like cash back?” prompt. The footnote indicates that “a transaction fee may apply.” The transaction fee is usually $1 no matter the amount of cash back. If one opts to get $10 cash back, one is charged a dollar. That’s a ten percent fee, for a service that costs the retailer nothing. It’s just another way for retailers like Dollar General to make a profit off of their customers, many of whom are very often living below the poverty line.

If an organic grocer or movie theater were charging a fee of this sort, I would likely be annoyed by it, but I wouldn’t be so annoyed that I would write about it. However, the poorest members of our communities do not shop at Whole Foods, and they do not often get a chance to go see the latest blockbuster at the theater. They can afford neither. In fact, they likely do not have either organic grocers or first-run theaters in their neighborhoods. Instead, they have Dollar General. Dollar General’s stores grow like kudzo in rural America. Even if there isn’t a real grocery store in most tiny communities, there’s probably a DG.

These ridiculous transaction fees are but one example of how corporations make billions of dollars by taking advantage of socioeconomically disadvantaged customers with few options. There are many other examples, though, and politicians continue to allow it at the expense of their poorest and most marginalized constituents.

Payday lending is one of the most sinister ways that large corporations exploit poor people. For those who are not familiar, payday lending goes something like this: People who are running short on money but who have a verified record of regular income (whether it be Social Security, SSI, payroll, etc.) are able to go to payday lenders and receive a cash loan to be repaid on payday. Often, borrowers are unable to repay their full loan balances and simply “roll over” their loan until a future payday, accruing all sorts of fees and additional interest. The annualized interest rate on these loans is often in the triple digits. Yes, that’s right. Sometimes the annual interest rate is over one hundred percent.

In defense of this practice, many payday lenders and their high-dollar lobbyists argue that they are simply offering a service to poor borrowers that said borrowers cannot obtain anywhere else. This is partially true. The poorest members of society have no access to traditional forms of credit. Some even lack access to checking accounts because of low credit scores or a history of financial missteps.

I know some people who make occasional use of payday lending because they genuinely have emergencies arise that they could not address without a short-term infusion of cash. I also know people, including members of my own family, who have been riding the high-interest payday loan merry-go-round for years, and who have paid thousands more back than they have borrowed yet still owe more. In debating the role of payday lending in our communities, it is essential that we take a nuanced approach. Some form of short-term credit is necessary for those mired in poverty. However, it is flat-out immoral that we regulate payday lending so loosely in many places that people end up feeling crushed under the weight of small high-interest loans that they have no hope of ever repaying. Taking out a $1,000 payday loan should not mean a person becomes tied to tens of thousands of dollars in debt.

Another egregious example of corporations exploiting the poor is rent-to-own retailing. Companies like Aaron’s and Rent-a-Center purport to offer a valuable service for the poor. Because those at the bottom of the socioeconomic spectrum are seldom able to save for big-ticket items like appliances or furniture, these retailers offer a pay-by-the-month scheme that often requires no credit check and no money down. The result is that customers pay as much as three times the retail price of the item, assuming they are able to make payments until the item is paid for. When they are not able to maintain the payments, the retailers simply show up to repossess the items.

Like payday lenders, rent-to-own retailers argue that they provide a valuable service to poor consumers. However, many observers, myself included, conclude that some rent-to-own practices are ethically questionable and tend to target vulnerable consumers who need immediate access to essentials like appliances and bedding. In many states, companies are not required to disclose the final price of the items. Instead, they simply tell customers the amount of the monthly or weekly payments. Because companies call the arrangement “rent-to-own,” in many places they are not required to disclose the amount of “interest” customers will pay because it technically isn’t interest. When consumers can no longer afford the payments and have to return the item, they often get no credit for payments they have made even if they have paid substantially more than the item is worth. Many customers never realize that they are paying as much as three times the retail price for their items. Those who do realize it likely have no choice apart from going without a bed or refrigerator.

In some instances, state attorneys general have successfully sued major rent-to-own retailers for violating usury and consumer protection laws. However, because these retailers are covered generally by state laws rather than by federal laws, there exists a hit-and-miss patchwork of regulations. Some consumers enjoy greater protections than others. The only determining factor is their location. Those states with more corporation-friendly attorneys general are unlikely to see any activity that might force retailers to behave more ethically toward their customers, because such enforcements will result in a drop in profitability for the retailers. Many major corporations spend good money to be sure that politicians protect their interests rather than the interests of consumers. Rent-to-own retailers and payday lenders are no exception. The poor, of course, can’t afford lobbyists or political contributions.

There are some who will argue that the free market, not the federal government, is the best solution to corporations that exploit the poor. However, those at the bottom of the socioeconomic spectrum, especially the rural poor, do not live in anything resembling a free market. Also, it is important that we label the behavior of rent-to-own companies and payday lenders as what it is: exploitation.

In the hills of Appalachia, poverty is often the rule rather than the exception. One of the most poverty-stricken ZIP codes in the United States is Manchester, Kentucky. Manchester is located in Clay County, which has a population of just over 20,000 people. According to the most recent US Census data available, the per-capita income average between 2011 and 2015 was just $13,802 (less than half the national average) and 46% of the population lives below the poverty line. In Manchester, Rent-a-Center is often the go-to option for poor people looking to buy appliances or furniture. The county has a Walmart, but the nearest discount appliance and furniture dealers are miles away, too far for many to drive. There are some locally-owned options, but few in Clay County are able to pay cash for major purchases given the high rate of poverty and the low rate of employment.

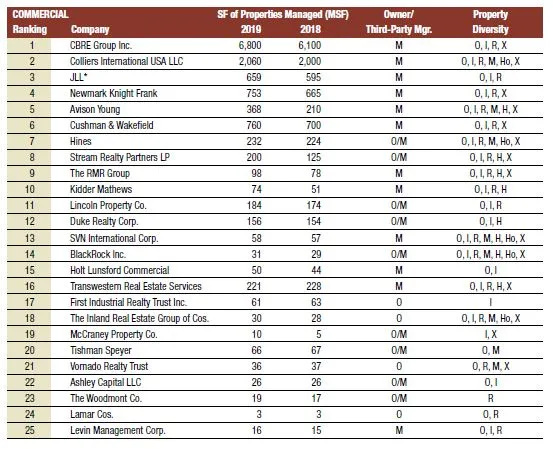

Largest Property Management Companies in the US

11. BH

Number of Units Managed: 106,353

10. Apartment Management Consultants, LLC (AMC)

Number of Units Managed: 132,364

9. FPI Management

Number of Units Managed: 155,000

8. Asset Living

Number of Units Managed: 159,352

7. Pinnacle Property Management Services, LLC

Number of Units Managed: 169,000

6. Cushman & Wakefield PLC (NYSE:CWK)

Number of Units Managed: 172,145

5. Lincoln Property Co

Number of Units Managed: 210,086

4. Greystar Real Estate Partners

Number of Units Managed: 698,257

3. Jones Lang LaSalle Inc (NYSE:JLL)

Number of Units Managed: N/A

Assets Under Management: $76.6 billion

2. Colliers International Group Inc (NASDAQ:CIGI)

Number of Units Managed: N/A

Assets Under Management: $92 billion

1. CBRE Group Inc (NYSE:CBRE)

Number of Units Managed: N/A

Assets Under Management: $143.9 billion

In addition to the rent-to-own retailers, Clay County also has no less than five payday lenders, but only two traditional banks. Conveniently, the primary shopping center in Manchester currently houses a Dollar General, a Rent-a-Center, and two payday lending branches, all within feet of one another.

In places like Manchester, rent-to-own and payday lending outfits thrive. They do so often to the detriment of the poor folks who frequent their businesses. Those promoting the so-called free market approach might argue that customers are not forced to do business with these types of companies. However, given their dire financial circumstances and lack of available options, poor people in Manchester have little choice. They are excluded from participating in the wider world of commerce, often because of forces beyond their own control.

Manchester is not a rare exception. Particularly in central Appalachia, rent-to-own retailers are often the only option for poor people, and payday lenders outnumber banks by large measure. In addition to being food deserts, many poverty-stricken communities are retail deserts. In the most isolated rural areas in Appalachia, Dollar General is one of the only available retail options. Within ten miles of our house in rural Jackson County, NC, there are four Dollar General stores, and our community isn’t even particularly isolated. Dollar General is the closest store to our home, and my wife and I tend to shop there by default because it is either that or a ten minute drive to the closest grocery store, or worse, a twenty minute drive into town. While we have the resources to go to town any time we want, many of our neighbors do not. The folks in the trailer park down the road often walk to Dollar General because they have few other options. This does not seem much like a free market driven by competition. Therefore, “free market” solutions simply do not work here.

Dollar General is, I believe, fully aware of the demographics of their shoppers. They know that there are often few ATMs near their locations, and their customers often lack access to traditional banking anyway and end up paying fees of three or four dollars to access their money at ATMs. Especially for people who depend on Social Security or SSI for their income, access to money is an important issue. Dollar General and similar retailers, it seems, understand this. Their solution is not to offer a resource for their customers but to profit from their customers’ limited access to funds. It’s cheaper than an ATM, but it’s a fee more affluent shoppers never have to think about. While there is nothing illegal about this, it is certainly morally questionable.

That’s the thing about the so-called free market. It makes no accounting for moral right or wrong. That, free market proponents allege, is up to the consumers. Poor consumers, however, still need to eat. They still need ovens and beds. Consumer choice and self-advocacy is often, like so many forms of social or political action, a full-stomach endeavor. When one is hungry, one’s ability to be an activist is diminished. When poor people have no choice but to do business with the greedy companies who reap a hefty profit from their customers’ lack of options, those drawing the short straw simply do what they must to survive. Surviving is what poor people do best, and it makes for a miserable life. I know, because I have been there.

When poor people have little option but to do business with discount retailers who charge cash-back fees, rent-to-own retailers who charge inflated prices, and payday lenders who mire their customers neck-deep in impossible-to-pay-back high-interest loans, they are even less likely to ever escape poverty. The stark reality is that poor people often pay substantially more for essentials – bedding, appliances, housing – than would those of us with means. If my wife and I needed a new washer, we’d shop around for the best deal and go buy it. In fact, we might even buy it from Amazon Prime and get free two-day shipping. When my mother, who lived her entire life in poverty, needed a new washer, she was forced to buy one from a rent-to-own outfit that charged her an outrageous delivery fee and hassled her every time she was even a few hours late on a payment. She probably ended up paying $2,000 for a $450 washer. The poor do not have access to Amazon Prime like the rest of us because they can’t afford a hundred bucks a year to subscribe. They do not get free delivery and obscenely low prices. They get fleeced.

The limited options available to those in poverty are rarely considered by the political ideologues who are so prone to victim-blaming. These retailers, who are all too often protected by state and federal lawmakers from both parties, package their predatory tactics as opportunities. What they are really selling are tickets on yet another segment of the poverty train. The politicians who protect them should be deprived of options and see just how much more expensive it is to survive. They should be ashamed for protecting those who profit from poverty, and those of us who know about it and have the resources to fight back should be ashamed for letting it happen to our neighbors.